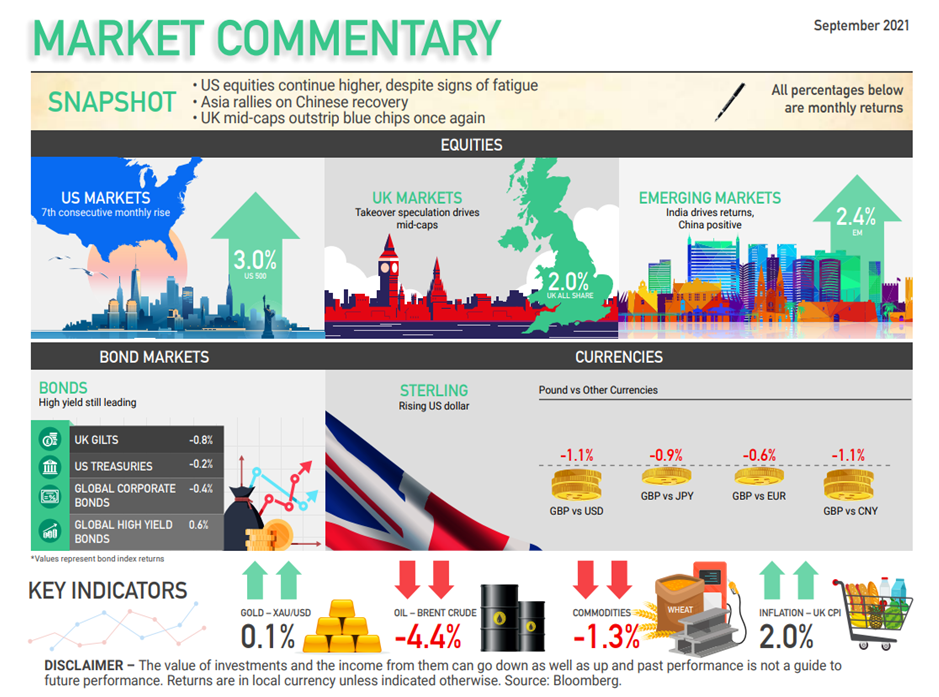

Major global equity markets all showed positive returns in August, led by the US and Japan. Emerging market returns were driven by India, China and Brazil.

GLOBAL MARKETS

US MARKETS

Reached new highs…

US equities reached new highs again in August, returning +3.0% over the month. The rise was broad, taking in both technology stocks and more defensive sectors. However, a range of indicators suggested a reduction in confidence moving into the Autumn period. Analysts’ forecasts continue to reflect the expectation that S&P 500 earnings will continue to grow at double-digit rates until 2023. However, the University of Michigan consumer sentiment index has collapsed to a ten-year low, suggesting that the boost from ending lockdown may be over. Up 3.0% (US 500)

EUROPEAN MARKETS

Positive returns…

Returns across the continent were almost universally positive, with strong rises in several of the peripheral European markets. The major developed nations were more muted, with rises limited to 3% or less. The overall return from the Stoxx Euro 600 Index was +2.0%. Manufacturing surveys taken early in the month showed the lowest levels since January. However, the fact that stocks have not shown the pattern of weakness that usually follows a US PMI peak, may suggest that the European markets are more firmly underpinned. MSCI Europe has now beaten the World ex US by over 10% in six months. Up 2.0% (Euro 600 Index)

UK MARKETS

Midcaps lead the way….

UK equities were led, once again, by the FTSE Mid-250 Index, despite Sterling weakness during the month. After July’s +2.5% return, driven by travel stocks, August saw the Index add a further 5%, driven primarily by bid-speculation, following a bidding war for aerospace supplier, Meggitt. Outside of the mid-cap part of the UK market, large and small-cap indices were also positive, with just a +1.24%s return from the FTSE 100 Index, which is still languishing below its pre- Covid level. Fears of supply problems due to Covid and Brexit weighed on shares, as did the growth in Delta-variant cases. Up 2.0% (UK All Share)

ASIAN MARKETS

Bounced back strongly…

Asian markets bounced back strongly in August, with Japanese shares gaining 3.1% and the Chinese Shanghai Composite Index rising by 4.3%. After recent weakness, stocks in the region were buoyed up by bargain hunting. Both developed and emerging markets in the region were stronger. Progress in Asia, where coronavirus cases have been rising again in recent weeks, was helped by the full approval of the Pfizer/Biontech vaccine. Wall Street’s strength also helped to underpin the Asian markets, as fears of imminent Fed tapering to be announced at Jackson Hole subsided. Up 1.9% (Asia Index)

DISCLAIMER – The value of investments and the income from them can go down as well as up and past performance is not a guide to future performance.

Jennifer Turner