Possible contagion from China rattles global markets. US equity markets weakened on talks of tapering the record $28.8tn debt and sooner than expected rate rises.

GLOBAL MARKETS

US MARKETS

Fell sharply on monetary policy fears

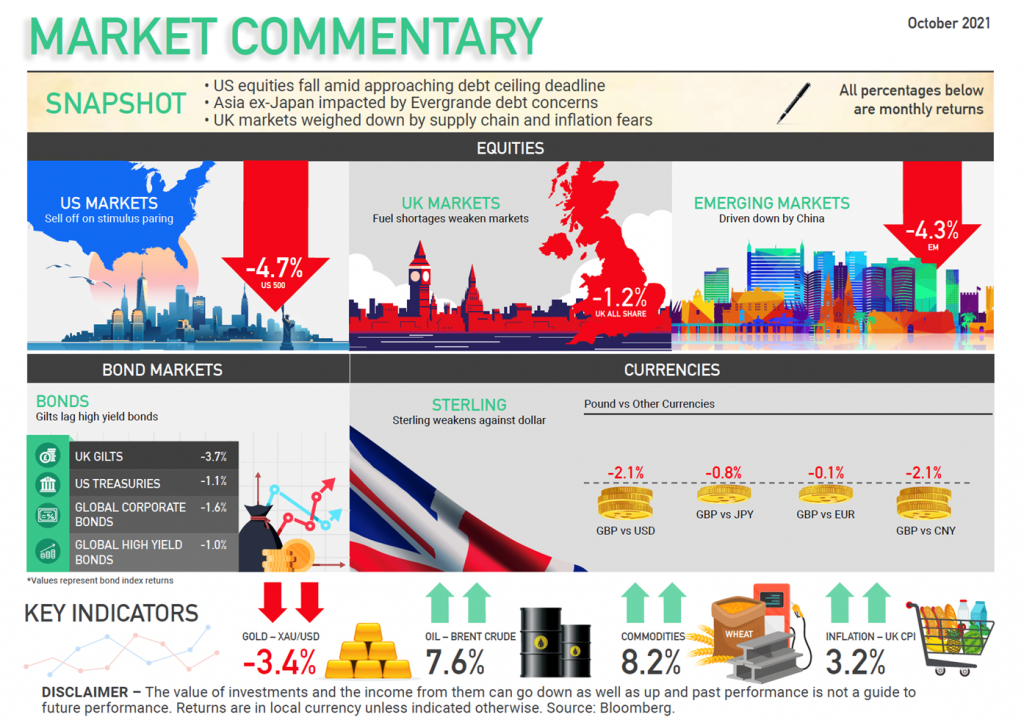

US equities fell sharply on monetary policy tightening fears. For the Fed, who has the dual goals of stable pricing and maximum employment, dealing with high inflation and high unemployment highlights the possibility of a policy error. US jobless claims rose for the third straight week, and the US government cut the extra, Covid-related, unemployment benefit of $300pw earlier than planned. The economy added 235k jobs in August – the lowest in 7 months. Down 4.7% (US 500)

EUROPEAN MARKETS

Energy concerns creating Headwinds

The pan-European Stoxx 600 index fell on slowing global growth and, in part due to, the energy crisis. Russian constraints on gas supply are helping to create a supply crunch in Europe. A combination of rising consumer energy costs, particularly in Italy & France, and supply chain disruptions, specifically in microchips, are creating economic headwinds. Manufacturing and Services PMI have both dipped in September to 58.6 and 56.0 respectively but both input and output costs are on the rise. Down 3.4% (Euro 600 Index)

UK MARKETS

Supply chain disruptions impacting markets

Markets were weak as supply chain disruptions led to chip shortages, and a brewing energy crisis fanned investor concerns. Strong performances from BP and Shell were not enough to offset a weakness in mid-caps, in particular travel stocks. The Bank of England governor, Andrew Bailey, alluded to earlier-than-planned rate rises, with CPI running at a 3.2% annual rate compared to a target of 2.0%. A number of smaller UK energy supply companies collapsed, unable to keep up with rocketing wholesale energy prices. Down 1,2% (UK All Share)

ASIAN MARKETS

Property developer unnerves markets

China unnerved global markets as its largest property developer, Evergrande, looked set to default on payments, after missing some of the $47.5mn coupon payments from a 2024 bond. Fears of contagion into China’s financial markets pushed the MSCI Asia ex-Japan index down. Japanese market rose, buoyed by the optimism surrounding the new PM, Fumido Kishida, who will take office in October. Markets expect the new PM to recruit a young cabinet with more women in senior roles. Down 3.4% (Asia Index)

DISCLAIMER – The value of investments and the income from them can go down as well as up and past performance is not a guide to future performance.

Jennifer Turner