Fed turns hawkish as elevated inflation persists. Government bonds underperform corporate bonds as faster rate rises loom

GLOBAL MARKETS

US MARKETS

Fed prepares markets for tapering and rate rises

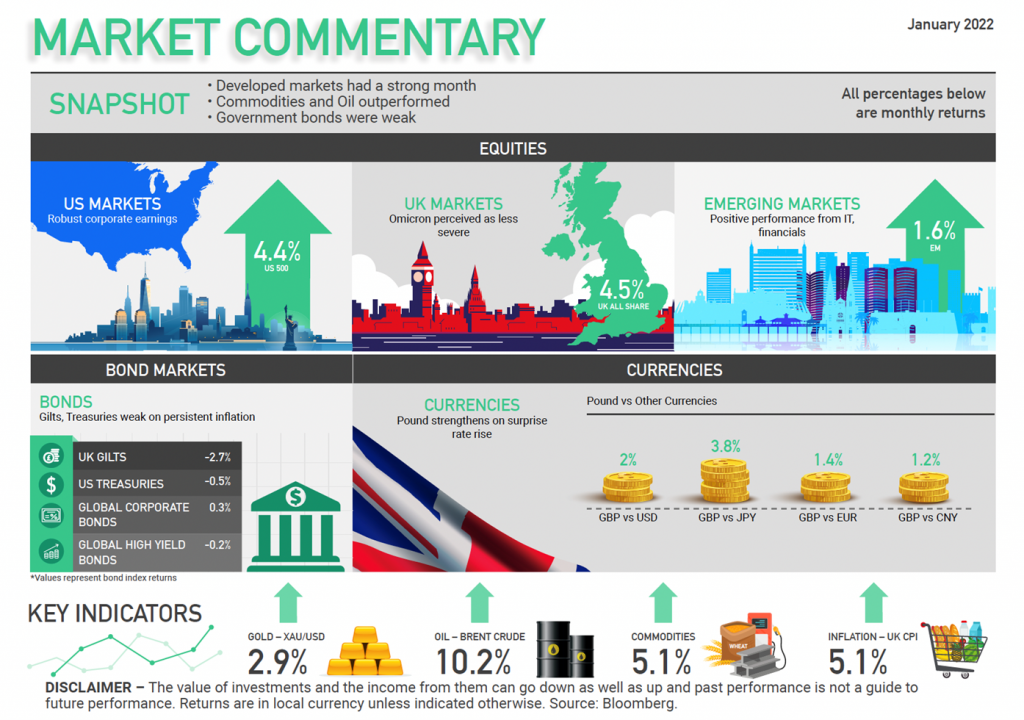

Fed manages to avoid another ‘taper tantrum’ and announces the end to net asset purchases as early as March, along with three rate rises planned for 2022. US corporate earnings rose to fresh highs of $2.5trn, while the unemployment rate fell to 3.9%, the lowest since February 2020. Inflation is a concern, as the annual inflation rate reached 6.8%, while the core rose to 4.9%. GDP growth in the third quarter was 2.3% on an annualised basis, much lower than the previous quarter’s 6.7% expansion, mainly due to Covid restrictions delaying businesses reopening Up 4.4.% (US 500)

EUROPEAN MARKETS

European markets outperform

European markets outperformed UK and US markets, as risk appetite returned following robust corporate earnings and the perception that the new COVID-19 variant is less severe than initially anticipated. Healthcare, banks, tech, and travel stocks were among the best-performing sectors. Inflation is still seen as temporary in the Euro area, where the eurozone’s annual inflation hit 5.0% in December. Core inflation, which excludes volatile prices such as energy, food, alcohol & tobacco is closer to the ECB’s 2.0% target at 2.6%. The ECB has so far ruled out a rate rise in 2022. Up 5.4% (Euro 600 Index)

UK MARKETS

The Bank of England raises Rates

The Bank of England raised rates by 15bps to 0.25%. CPI inflation was 5.1%, much higher than the Bank’s target of 2.0%, prompting a letter to the Chancellor. The letter outlined the ‘uneven effects’ of COVID-19, which included supply bottlenecks, as well as a global rise in energy, commodity, and household goods prices. While the rate rise benefited banks and financial stocks, travel & leisure stocks and retailers bore the brunt of the supply chain disruptions. The more defensive areas of the domestic market, such as supermarkets, including M&S, staged a turnaround on the back of increased spending for the festive period. Up 4.5% (UK All Share)

ASIAN MARKETS

Omicron fears impact China

Fears that the faster spreading Omicron variant of COVID-19 would derail growth hit China the worst, due to its ‘zero-Covid’ policy. Hong Kong and Singapore markets were also weak, as investors anticipated more restrictions may be put in place. Tech stocks lifted Taiwan and Indonesian markets. Japan performed exceptionally well, a representation of the post-pandemic reopening of markets – shipping and commodities-related stocks enjoyed rallies from a sector switch, while stocks that were in high demand during the pandemic, such as healthcare and video gaming, sold off. Down 3.5% (Asia Index)

Need to know more? If you have a question, would like more information, or are seeking financial planning or Wealth Management advice please contact hello@jarrovian.co.uk

DISCLAIMER – The value of investments and the income from them can go down as well as up and past performance is not a guide to future performance.

Jennifer Turner