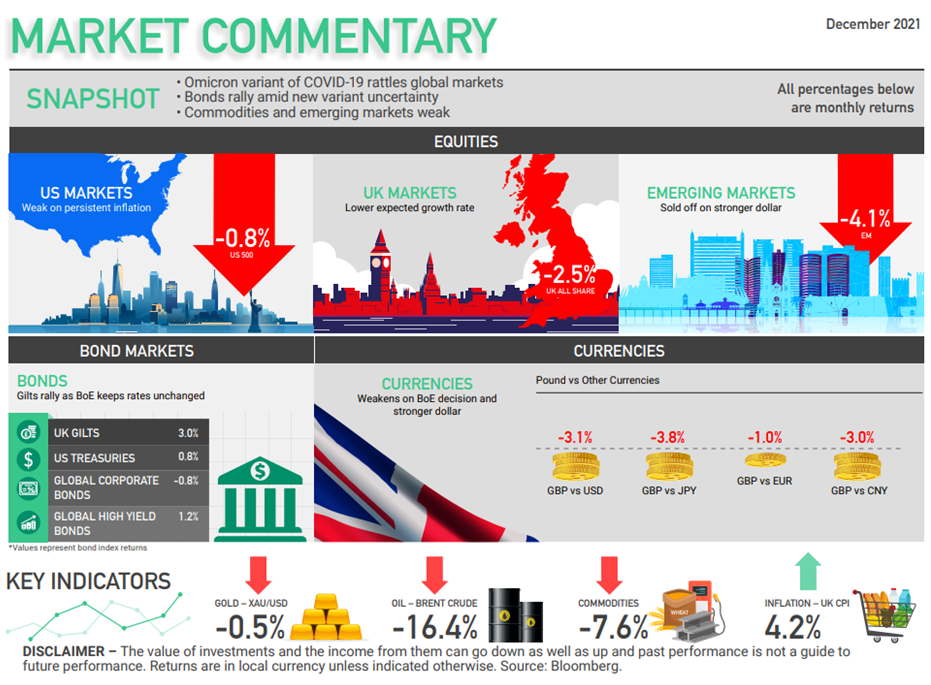

New COVID-19 variant hurts both developed and emerging markets. Oil & commodities fall, reversing earlier course.

GLOBAL MARKETS

US MARKETS

Hawkish comments by the fed affect the markets

The Federal Reserve’s Jerome Powell’s hawkish comments on faster tapering caused a loss of momentum to the long US market rally, with some intra-day moves exceeding 3.6% on the announcement. It seems the Fed remains focused on the higher-than-expected inflation numbers, and less on the effects of the new COVID-19 variant to the economy. CPI inflation reached 6.2% in October, ahead of the expected 5.8%. Energy prices, housing, and food were the biggest contributors. The Fed has said that it will begin to taper bond buying to counter inflation. Down 0.8.% (US 500)

EUROPEAN MARKETS

Markets sell-off on new variant and renewed lock-down measures

A rapidly rising number of COVID-19 cases in Europe led some countries to enforce mandatory measures, causing unrest and impacting the markets. Eurozone inflation reached 4.9%, the highest level since records began, knocking investor confidence. Energy prices and the cost of imported goods were the major factors driving price rises. The ECB insists that price rises will dissipate in 2022. Core inflation, which strips away volatile items such as food, energy, and tobacco, was also above the ECB’s target rate of 2%, at 2.6%. Down 2.6% (Euro 600 Index)

UK MARKETS

BoE decision to hold rates driven by a new variant

The BoE decided to keep rates unchanged despite market expectations. This delay in implementation was not sufficient to counteract the negative impact of the new variant, which was particularly felt in small caps and sectors such as airlines. UK CPI reached 4.2%, as the shortage of goods & services and staff continue to push prices higher. UK house prices rose 10% in November from a year ago, according to Nationwide. Retail sales were buoyant at the beginning of the month. Down 2.5% (UK All Share)

ASIAN MARKETS

Emergence of new variant hits the markets

Asian markets, including Japan, sold off with the emergence of the Omicron variant. Japan announced it was closing its borders and China has a zero COVID-19 policy. China has an oversupply of real estate, with slowing demand and a $5tn overhang of debt impacting this sector. The Chinese economy grew 4.5% in Q3, lower than the expected rate of 5.2%. The US Fed’s announcement of faster tapering is also weighing down on emerging markets, where the prospect of rising rates in the US will be a heavy burden for many companies borrowing in US Dollars. Down 3.5% (Asia Index)

Need to know more? If you have a question, would like more information, or are seeking financial planning or Wealth Management advice please contact hello@jarrovian.co.uk

DISCLAIMER – The value of investments and the income from them can go down as well as up and past performance is not a guide to future performance.

Jennifer Turner