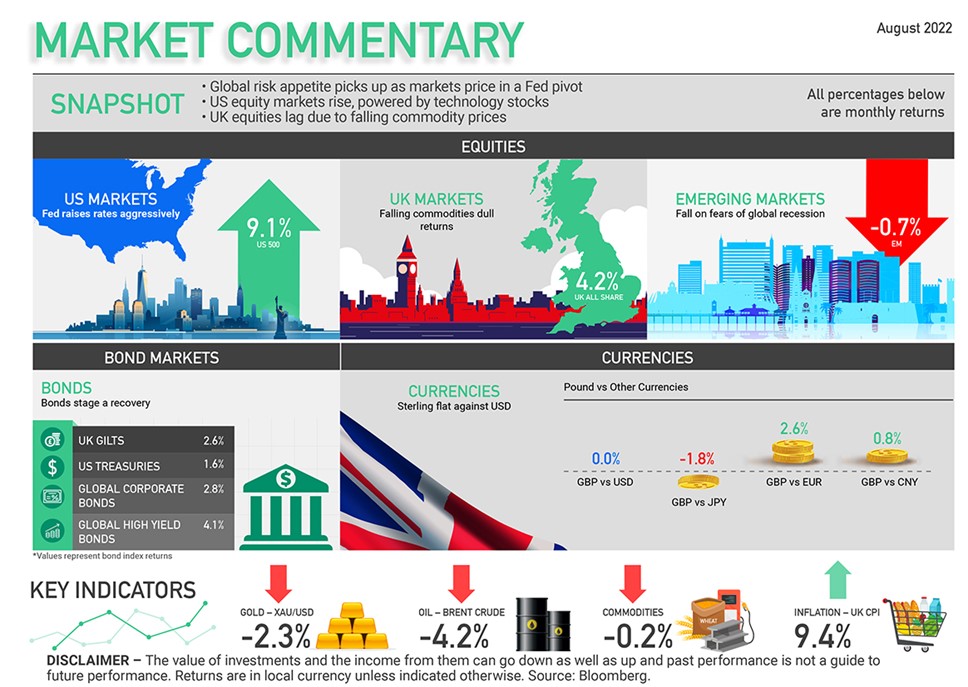

Risk assets rally amid a backdrop of high inflation and slowing economic growth. Despite little change in underlying fundamentals, markets appear to be pricing in rate cuts for 2023

GLOBAL MARKETS

US MARKETS

Despite fed tightening and mixed company results, technology stocks rally

The US economy contracted a second quarter running, this time by 0.9% (annualised). With the Fed tightening more aggressively than anticipated, investors now appear to be forecasting interest rate cuts in 2023. Although technology stocks had mixed results, with Netflix reporting better than expected ‘slowing’ revenue growth, and Alphabet (Google) disappointing on both earnings and revenue, despite advertising revenue rising by 0.9%, investors appear to be picking the best of the worst news, contributing to an overall tech stock rally. Up 9.1% (US 500)

EUROPEAN MARKETS

Eurozone shares rise despite new inflation highs and continued energy challenges

Eurozone inflation hit fresh highs of 8.9% in July, driven by energy and food prices. Russia announced a reduction of gas supply to the region, leading the European Commission to request that member countries reduce energy consumption by 15%. With the collapse of Draghi’s Italian government and the increased likelihood of a recession, the Euro came under pressure, falling below parity with the US dollar. It was later supported by the ECB’s decision to increase rates by 0.5%. Euro area shares fared well as the economy grew by 0.7% in the second quarter, which was better than expected. Up 7.6% (Euro 600 Index)

UK MARKETS

Falling commodity prices are a drag on UK equity markets

Falling commodity prices meant the FTSE100, due to its higher exposure to commodities, lagged other developed equity markets. The Bank of England is expected to increase interest rates by 0.5% as a means to cool inflation, with UK annual inflation rising to a 40-year high of 9.4% in the year to June 2022. While the Conservative Party decides shortly on who will lead the country next, UK economic growth is expected to slow as a result of multiple factors, including nationwide strikes. Up 4.2% (UK All Share)

ASIAN MARKETS

Inflation, China, and the potential for a recession weigh on the region

Emerging Markets fell as inflation and the potential for a recession impacted the region. China’s economy slowed down by -2.6% in the second half of 2022, as it continues with regulatory crackdowns and partial lock downs in some cities (in response to domestic COVID-19 cases). In Japan, markets were up on the back of a pickup in private consumption and lower inflation in the region (compared to other developed markets). Down -0.9% (Asia Index)

Need to know more? If you have a question, would like more information, or are seeking financial planning or Wealth Management advice please contact hello@jarrovian.co.uk

DISCLAIMER – The value of investments and the income from them can go down as well as up and past performance is not a guide to future performance.

Jennifer Turner