US leads global markets on the back of strong earnings. UK large-cap rose strongly, while China continued to recover.

GLOBAL MARKETS

US MARKETS

US leads global markets based on earnings

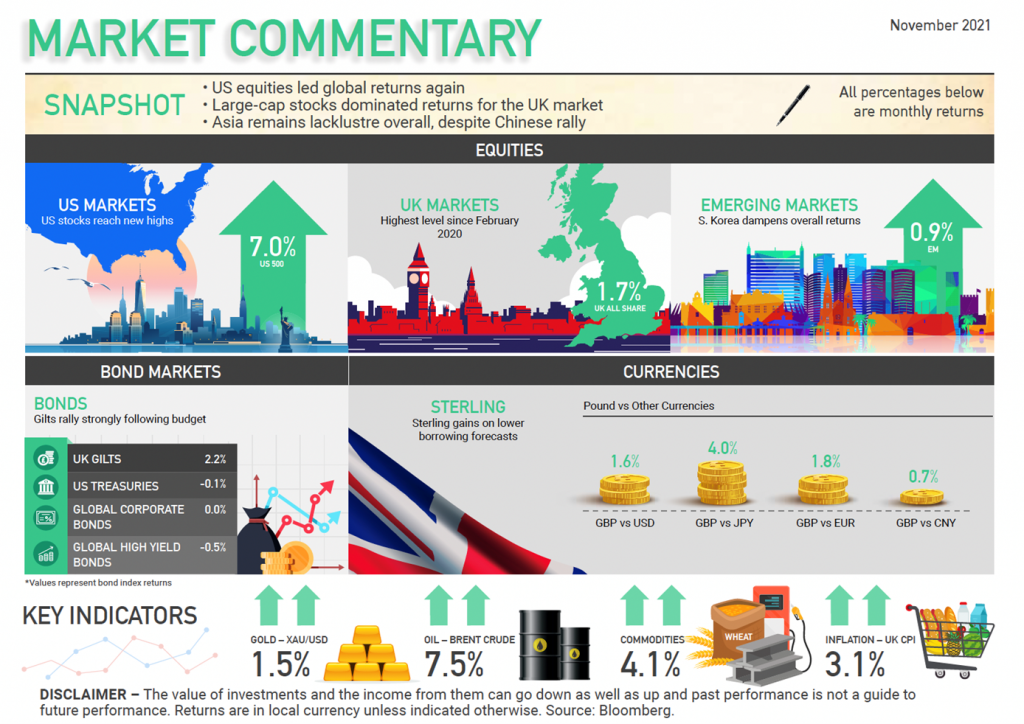

Fears of a sell-off in US equities during October proved unfounded, as the S&P 500 rose by almost 7%; its strongest rise this year. More than half of the S&P 500 constituents have reported Q3 earnings, and, despite some disappointments from major tech stocks, the overwhelming. The majority have beaten expectations. However, the causes for concern have not gone away. Supply chain disruptions continue, and economic growth has been more sluggish than anticipated. On the flip side, inflation may yet lead to the Fed raising rates earlier than expected. Up 7.0% (US 500)

EUROPEAN MARKETS

Torn between higher inflation and earnings

European markets were torn between the optimism coming from US equities, and the uncertainties in Asia. EU markets saw an uptick in inflation, together with weak economic data. Inflation continued to rise across the EU, the Q3 forecasts for inflation and GDP were also poor. This, combined with overseas uncertainties, such as the debt problems of Evergrande, the Chinese property giant, created an unsettling background for investors. However, the ECB restated its belief that the current bout of inflation will prove to be transitory, and this was sufficient to send European equities higher over the month. Up 4.6% (Euro 600 Index)

UK MARKETS

UK large-cap rose strongly

After several months of leadership by the mid-cap section of the UK market, the large-cap FTSE 100 rose strongly, to dominate UK returns. Continued rises in the price of Brent Crude boosted oil shares – a big component of the FTSE 100, whilst, elsewhere, more modest losses from Whitbread and an uplift in sales forecast from Reckitt Benckiser, helped to bolster sentiment towards the major multinationals in the UK market. Unusually, the FTSE 100 led the way, in spite of stronger Sterling, which is usually a signal to switch into other areas of the market. Up 1.7% (UK All Share)

ASIAN MARKETS

China continues to recover

Gains were seen in many Asian markets, including China, which continued to recover from the shocks that hit it during the summer. But Japan and S. Korea dragged overall returns down. China and India both contributed positively to the Asian regional returns during October, as many markets were buoyed by the strength of US equities. However, S. Korea continued its decline, falling into correction territory, as foreign selling continued despite strong results from entertainment and tech giants, including Samsung. Japanese shares also trended lower, as the new prime minister failed to make an impression on investors. Up 1.1% (Asia Index)

Need to know more? If you have a question, would like more information, or are seeking financial planning or Wealth Management advice please contact hello@jarrovian.co.uk

DISCLAIMER – The value of investments and the income from them can go down as well as up and past performance is not a guide to future performance.

Jennifer Turner